If we observe graphs with attention to detail we can notice that the candles can have different bodies and shadows. The arrangement of the body and shadows give rise to different formations, each one with a specific name, which are given different meanings.

Spinning Tops

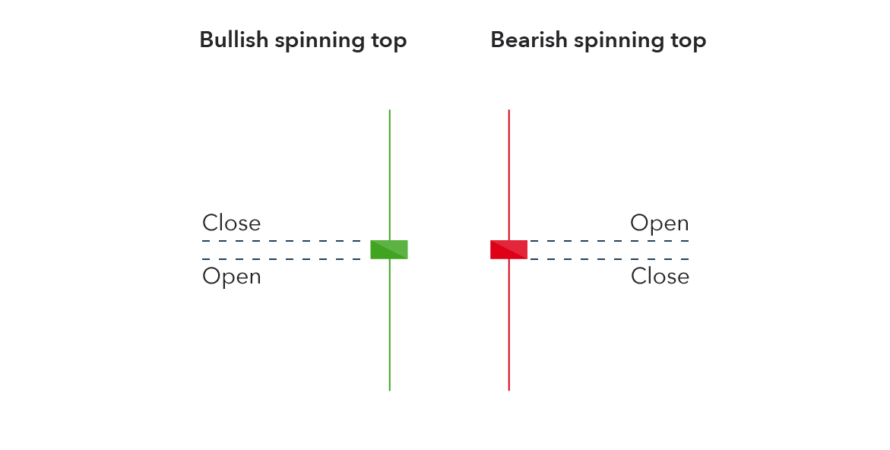

They are candles with long shadows, both lower and upper, and small bodies. This formation is indicative of a pattern of indecision in the market between supply and demand (sellers / buyers). Body color is not very important in this training.

Why this meaning? A small body tells us that the movement in the market has not been very wide and the opening and closing price has been close but having long shadows on both sides indicates that there was high activity of both buyers and sellers but that neither had strong enough to give a clear direction.

What will happen if the top appears during an uptrend? It will indicate that there are not many buyers left with sufficient confidence in the continuation of the trend and therefore may represent a possible change in trend.

On the contrary, if the top appears during a downtrend it could indicate a possible change to an uptrend.

Marubozu

It is a formation characterized by the absence of shadows on the sail. This means that the maximum will be equal to the closing price and the minimum to the opening price, in an empty candle (bullish) and vice versa if it is a bearish candle.

Therefore we can distinguish two types of marubozu:

White Marubozu: it is a marubozu formed in a bullish candle (remember that this candle is called empty and that the color will be the background color you use or, if your platform allows it, the color that you choose yourself). It is characterized by the absence of shadows and a more or less large body. In this marubozu the opening price is equal to the minimum and the closing price is equal to the maximum. This indicates that buyers dominated the entire period. It can be indicative of an uptrend continuation or the start of a trend reversal pattern after a bullish period.

Black Marubozu: Contains a large body and the opening price is equal to the high and the closing price is equal to the low. It is therefore a clearly bearish candle and usually occurs in downtrend continuity patterns or trend reversal patterns after a downtrend period.

Doji

Doji candles will probably be the ones you hear the most about on your forex journey.

Doji candles have the same opening and closing price or their body is extremely short, so short that it appears as a line. Its formation suggests indecision in the market, a struggle between supply and demand. Buyers and sellers fight each other, the price moves up and down the opening price to end up closing extremely close to the same opening price.

There are 4 important types of Doji candles serving the upper and lower shadows:

- Longleg: Long shadow doji candle.

- Headstone: also known as a grave doji. The lower shadow is absent or practically absent while the upper shadow is long.

- Dragonfly: also known as a flying dragon. It is a doji with no upper shadow and long lower shadow.

- Line: Also known as 4-price doji. No shadows, neither top nor bottom.

A doji alone could indicate a trend reversal pattern, however it is much more important to consider the doji in conjunction with the preceding candles.

- Long white candle followed by doji: A doji preceded by a series of large-bodied white candles may indicate a possible reversal from the uptrend to the downtrend.

- Long-bodied black candle followed by a doji may indicate an exhausted downtrend and may be a good opportunity to look for signs to go higher.

In both cases, the simple fact of the formation of a doji does not imply an immediate change in trend, other signals that confirm this change will be necessary.